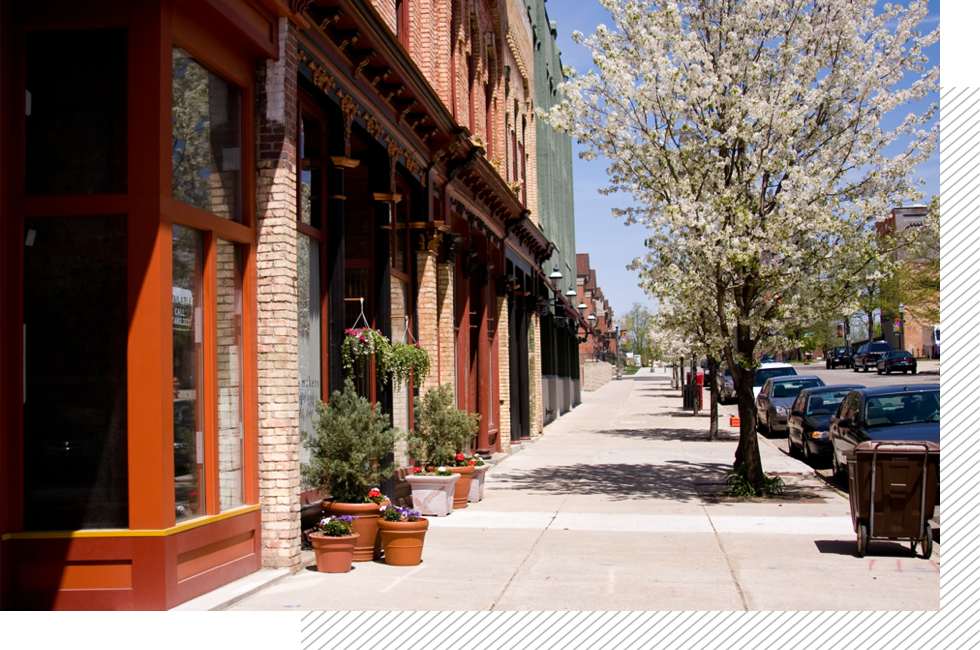

Small Businesses

Credit unions are better for small businesses across Minnesota as they expand loan opportunities and empower job growth and foster economic development at all levels.

-

Carrie F Firefly Credit Union

Carrie F Firefly Credit Union -

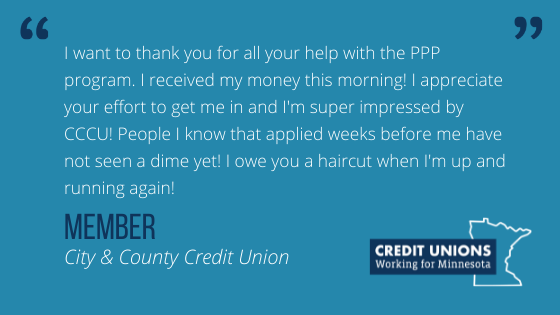

Member City & County Credit Union

Member City & County Credit Union -

Mark B. Ideal Credit Union

Mark B. Ideal Credit Union -

Abby H. Ideal Credit Union

Abby H. Ideal Credit Union -

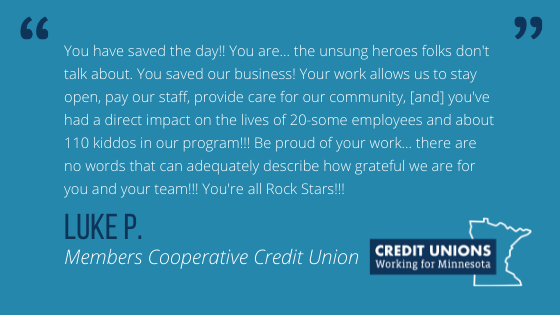

Luke P Members Cooperative Credit Union

Luke P Members Cooperative Credit Union -

Brooke B. First Alliance Credit Union

Brooke B. First Alliance Credit Union -

Greg H. First Alliance Credit Union

Greg H. First Alliance Credit Union -

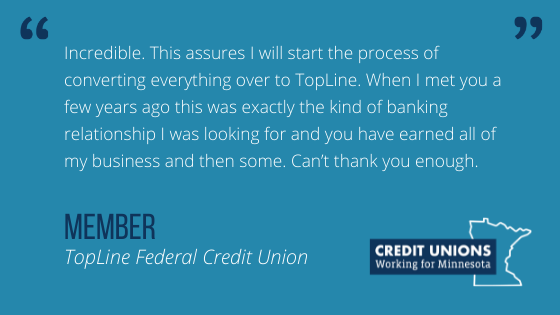

Member TopLine Federal Credit Union

Member TopLine Federal Credit Union -

Karl C. First Alliance Credit Union

Karl C. First Alliance Credit Union -

Jameson H. First Alliance Credit Union

Jameson H. First Alliance Credit Union -

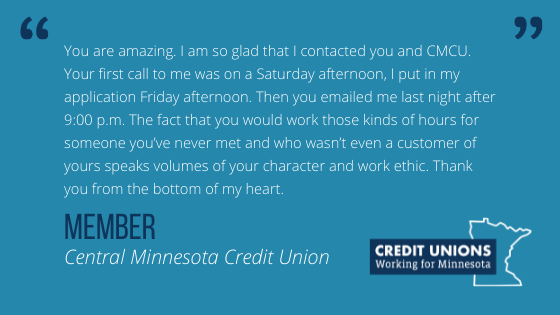

Member Central Minnesota Credit Union

Member Central Minnesota Credit Union -

Rick M (1/2) Red Wing CU

Rick M (1/2) Red Wing CU -

Aaron D Red Wing CU

Aaron D Red Wing CU

Filling the Gap for Small Business

At the heart of any community are the small businesses and entrepreneurs that sustain the local economy. The coronavirus pandemic closed the doors of many small businesses, but many more were able to survive because credit unions understood true small businesses needed immediate support more than massive corporations.

Small businesses will help this country recover, just as they did following the Great Recession. About half of all private-sector employees and two-thirds of net new job creation between 2000 and 2017 are a result of small businesses and they support received from their communities. Minnesota credit unions continue to do their part to support the local communities they serve, originating well over $2.5 billion in business loans for their members.

Credit unions have extended business loans to their members for over a century. Since the very beginning, they provided capital to businesses without any restrictions –until banking lobbyists pressured Congress into saddling credit unions with an artificial cap on business lending of 12.25% of assets in 1998, severely limiting their ability to help provide capital to small businesses that desperately need assistance.

Nearly 1,900 credit unions provide small business loans to their members, but regulatory burdens are holding credit unions back from doing more to help local economies.